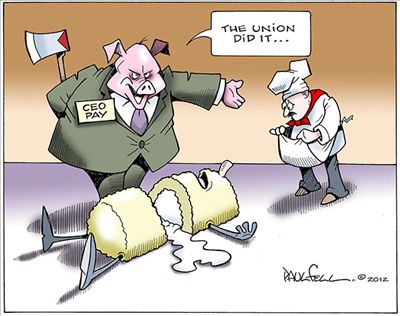

Over the last decade Hostess has been mismanaged by bankers, not bakers. Private equity firms “Bainstyle vulture capitalists,” as AFL-CIO President Richard Trumka explained in an article for the Daily Kos, “invested in Hostess to profit not by making quality products, but by bleeding the company of every dollar before discarding it.” The company has filed for bankruptcy twice in the last 10 years, forcing contract concessions from the nearly 15,000 unionized employees. Hostess has had six different CEOs since 2004. With the current CEO, Gregory Rayburn, receiving a 300 percent increase in compensation. The management firm raised the pay of the top nine executives between 35 to 80 percent all while asking employees to take cuts of more than 30 percent. In addition, executives overseeing liquidation of the company will receive 1.75 million in bonuses. The company also stopped paying into the Multi Employer Pension Plan (MEPP)—which is reportedly underfunded by as much as $2 billion.

Over the last decade Hostess has been mismanaged by bankers, not bakers. Private equity firms “Bainstyle vulture capitalists,” as AFL-CIO President Richard Trumka explained in an article for the Daily Kos, “invested in Hostess to profit not by making quality products, but by bleeding the company of every dollar before discarding it.” The company has filed for bankruptcy twice in the last 10 years, forcing contract concessions from the nearly 15,000 unionized employees. Hostess has had six different CEOs since 2004. With the current CEO, Gregory Rayburn, receiving a 300 percent increase in compensation. The management firm raised the pay of the top nine executives between 35 to 80 percent all while asking employees to take cuts of more than 30 percent. In addition, executives overseeing liquidation of the company will receive 1.75 million in bonuses. The company also stopped paying into the Multi Employer Pension Plan (MEPP)—which is reportedly underfunded by as much as $2 billion.

The truth is that the Bakery Workers union, along with the other unions representing workers at Hostess, gave the company more than $110 million in annual concessions to help it restructure after its 2004 Chapter 11 bankruptcy filing.

According to documents filed by BCTGM with the bankruptcy court—concessions were given in exchange for assurances by the company that it would restructure itself in a manner that would provide a real plan for establishing a stable business with secure jobs for thousands of employees.

The November 19, 2012 documents, filed by the BCTGM states:

As part of the negotiations during the first bankruptcy filing the company said that they would reinvest the monies saved through the BCTGM’s concessions in the company, specifically promising to focus on brand building, modernizing its plants and trucks, investing in new technology that other baking companies were employing and, importantly, developing new products to increase revenue in the face of a national trend away from sweet goods and bleached flour breads.

However, upon emergence, the debtors were burdened with $773 million in secured debt—in excess of $100 million more than the 2004 Debtors had when the cases were initially filed. The BCTGM told the Debtors prior to emergence that this increased debt load—unheard of in a chapter 11 process—would make it impossible for the Company to keep its promises and would inevitably result in a second bankruptcy. It was right. Instead of reinvesting the money saved as a result of the BCTGM’s concessions, plant machinery was not replaced, new technology was ignored, and new product development never occurred. The Company’s debt continued to grow, and its sales and revenue decreased.

Fast forward to 2012, Hostess earned profits of more than $2.5 billion but ended up with a loss of $341 million as it struggled to pay the interest on the $1 billion in debt the management firm had saddled it with over the last eight years. Silver Point and Monarch, two hedge fund firms specializing in distressed debt, had purchased controlling interest in the company after the initial Chapter 11 filing. The two firms cared little about building a successful company. For these distressed-debt specialists it is all about the bottom line. They will make more money from the liquidation of the company’s assets than they would have from the success of Hostess. Picking the bones clean, they’ll line the pockets of their shareholders while 15,000 good middle-class jobs are gone. Had the BCTGM given in and allowed the company to abrogate the union contracts, those same 15,000 middle-class jobs would be gone.